Call Us: 904-501-8613

Home Market Value: How to Determine Your Home’s Market Value

“Understanding your home’s worth isn’t just a number—it’s a key to unlocking financial opportunities.” I recently came across a statistic: nearly 80% of homeowners who know their property’s true worth make more confident decisions when selling or refinancing. In this post, I’ll walk you through the essential methods for evaluating your home’s worth in the competition of today’s Home Market Value.

Understanding Home Value & Its Importance

Why Knowing Your Property Value Matters

Grasping your home’s property value is fundamental to making informed decisions—whether you’re planning to sell, refinance, or challenge your tax assessment. When you know the true market value of your property, you stand a better chance of negotiating deals that work in your favor. This knowledge also equips you to better understand loan offers and the equity you’ve built over time.

How Much Is My House Worth?

A question I hear often is, ” how much is my house worth?” Knowing the answer can significantly impact your financial planning and decision-making process. The answer isn’t static—it varies with market conditions, neighborhood trends, and the unique features of your home.

Methods to Calculate Your Home’s Value

Determining the value of your home involves several approaches. Here’s a breakdown of the most reliable methods:

Leverage Online Valuation Tools for a Property Value Estimate

Online Automated Valuation Models (AVMs) are a great starting point. These tools generate a property value estimate based on public records and recent sales data. While useful, remember that these estimates are rough—they don’t account for your home’s condition or unique upgrades.

Utilize the FHFA House Price Index for Real Estate Values

The FHFA House Price Index provides insights into real estate values by tracking changes over time using historical data. This tool is beneficial to see long-term trends in your area, although it might not reflect recent renovations or market shifts.

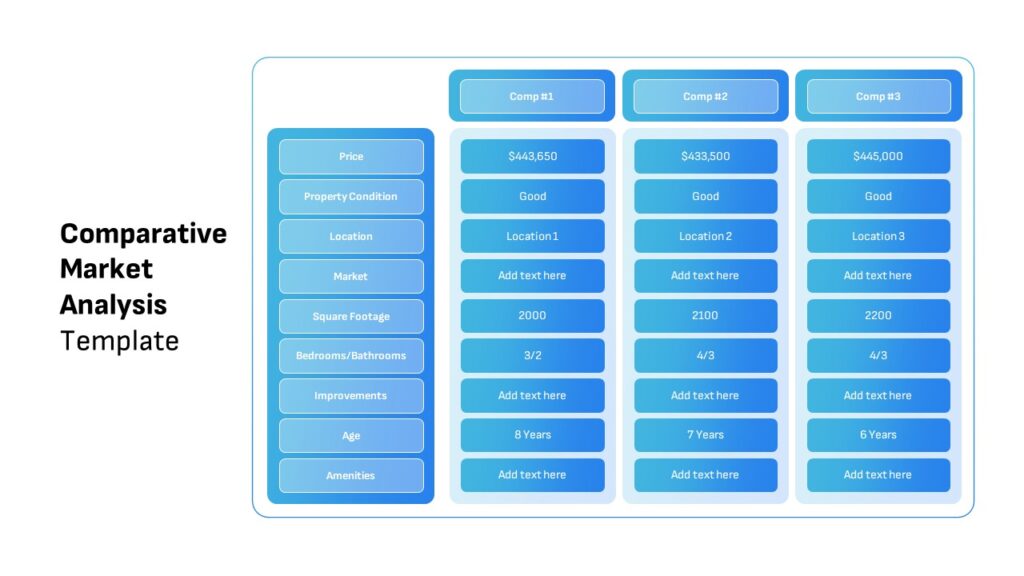

Get a Comparative Market Analysis to Determine Home Market Value

A Comparative Market Analysis (CMA) from a local real estate agent can help determine value of home by comparing your property to similar homes in the neighborhood that have recently sold. This method gives you a tailored view of your home’s worth based on current market conditions.

Hire a Professional Appraiser for an Accurate House Value

For the most precise evaluation, hiring a certified appraiser is essential. An appraiser examines your home’s physical condition, location, and features to provide an accurate house value. This professional opinion is often required by lenders when refinancing or applying for a mortgage.

Analyze Comparable Properties for Reliable Valuation

Reviewing recent sales of similar homes—or comps—is a straightforward method to how to calculate the value of your home. Adjustments for differences in size, condition, and upgrades help refine the final estimate. It’s a hands-on approach that many buyers and sellers find invaluable.

How Market Value is Determined in the Real Estate Market

Fair Market Value Explained – The Current Value of a House is Its Market Price

In the real estate world, the current value of a house is its market price, determined by what buyers are willing to pay under normal conditions. This concept is crucial for understanding the difference between a listing price and a final sale price.

Appraisals, Comparable Sales, and IRS Guidelines for Real Estate Values

Appraisals combine the methods of comparable sales with specific IRS guidelines to establish how to determine home market value. These guidelines ensure that the evaluation is thorough, accounting for both the tangible and intangible factors that affect how to determine value of home.

Expert Tips for Accurately Determining Home Value

Consult Real Estate Agents and Certified Appraisers

Talking with local real estate experts can offer insights you might miss on your own. Certified appraisers and experienced agents have in-depth knowledge of local trends and can provide a solid market value assessment that goes beyond online tools.

Combine Multiple Methods for a Comprehensive Evaluation

No single method can capture every nuance of your home’s worth. For the best results, use a mix of online tools, CMAs, and professional appraisals to arrive at a robust how to determine home market value. Combining these approaches provides a more complete picture and reduces the risk of undervaluing or overvaluing your property.

The Bottom Line: Evaluating Your Home’s Worth

Accurately assessing your home’s market value is critical. Whether you’re curious about how to determine value of home for a sale, refinancing, or simply keeping tabs on your investment, knowing these methods is empowering. By using online tools for a quick property value estimate, consulting professionals, and analyzing comparable sales, you can make informed decisions that reflect the true house value of your property.

In essence, understanding your home’s worth isn’t just about numbers—it’s about unlocking potential opportunities in the dynamic world of real estate. Take the time to explore these methods, and you’ll be well on your way to confidently navigating the real estate market.

Each section of this guide provides actionable, in-depth advice to help you understand and calculate your home’s market value. Remember, your home’s worth is more than just a figure—it’s a powerful tool for making smarter financial decisions.